UK Government’s BritCard Digital ID Warning Sparks Fierce Debate Behind Closed Doors

So, the UK government is rolling out a new digital ID scheme called the ‘BritCard’ — fancy name, right? But here’s the kicker: over two and a half million people have already put their names on a petition against it. Prime Minister Sir Keir Starmer announced it’s coming in 2029 and might be mandatory for anyone working in the UK, aiming to crack down on illegal migration. Sounds straightforward until you realize that while it’s technically “voluntary,” refusing the app could seriously mess with your job prospects. It’s got people asking—are we stepping into a brave new world of convenience or heading straight into mass surveillance territory? Fintech experts are waving red flags about a government monopoly, warning about stifling innovation, and honestly, it’s a lot to unpack. So, what happens when technology meant to make life easier threatens to complicate it even more? Time to buckle up and dive into the debate.

The government has been issued a stark warning over introducing the new digital ID scheme.

Dubbed the ‘BritCard’, the new system has received quite a mixed response, with over two and a half million people signing a petition against it.

The Prime Minister, Sir Keir Starmer, announced the plans last month, stating that they would be introduced in 2029 and would be mandatory for those working in the UK as part of a bid to tackle illegal migration.

While the scheme is described as voluntary, and Brits can choose to refuse to download the app, it’s clear that if that’s the case, people will face employment issues.

Some opposers to digital ID say they think it would ‘be a step towards mass surveillance and digital control’, while the government says it is ‘committed to making people’s everyday lives easier and more secure’.

However, Fintech leaders are warning against there being a government monopoly on digital identity.

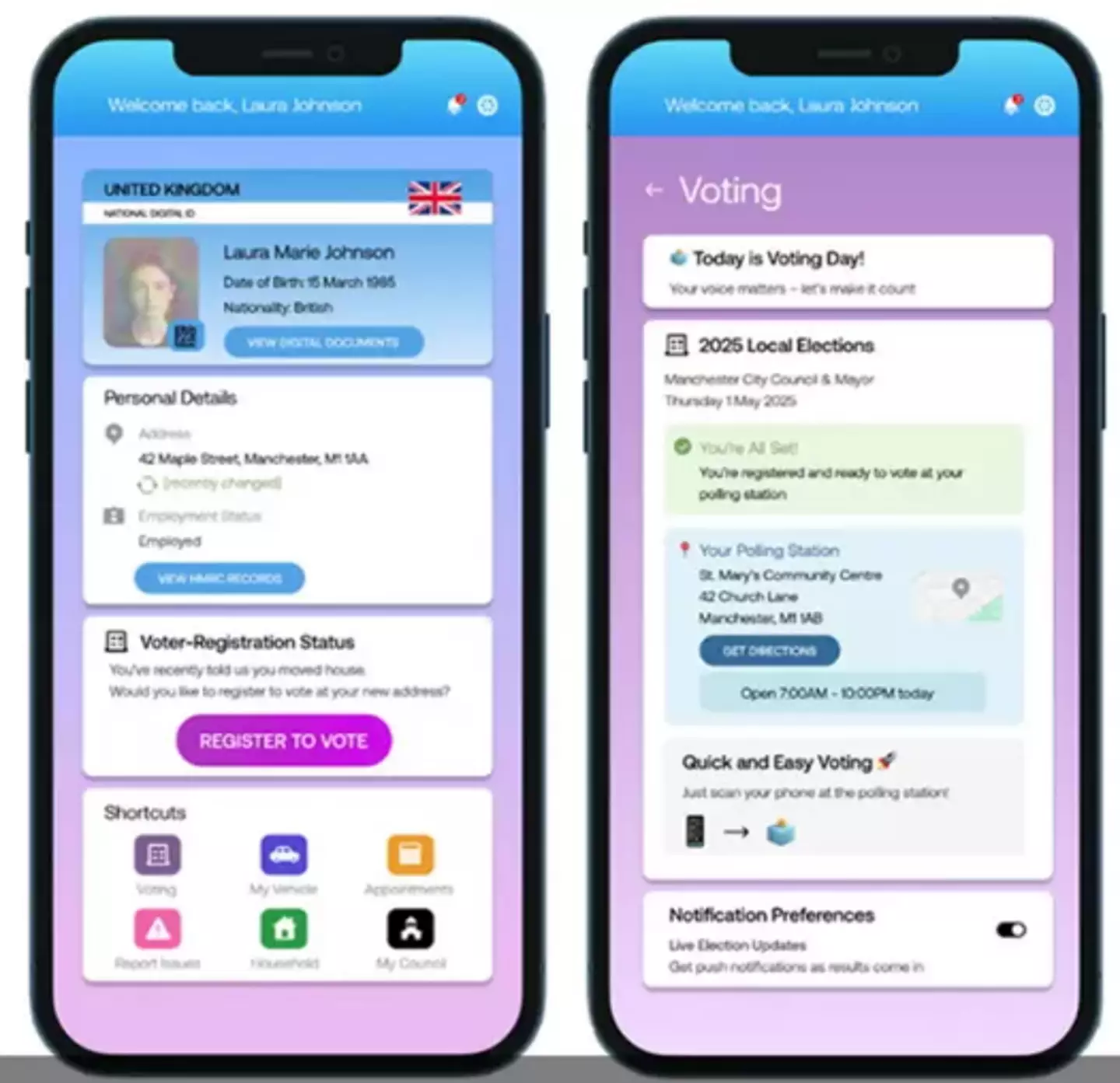

A mock-up of a digital ID card that the UK government has proposed (Tony Blair Institute)

Janine Hirt, CEO of Innovate Finance and RegTech UK, said while government support for digital identity is welcome, she has a warning of unintended consequences of the scheme in the UK.

“Reusable digital identity and verification is a critical component of the tech stack that forms the building blocks for fintech innovation in the UK – helping to reduce fraud and enable financial inclusion, she said to Finextra.

“The decision to mandate Government ID however risks the discussion being focused on civil liberty and sovereignty – rather than the utility and innovation this technology can bring to people across the UK.”

She also added that mandating this government digital ID may ‘crowd out companies who have been developing innovative solutions which are accredited against the government’s own legal framework’.

And Jonathan Frost, director of global advisory for EMEA at BioCatch, said that the digital ID is not some ‘silver bullet for illegal work, informal economies or fraud’.

Well over two million people have signed a petition against the digital ID scheme (Martin Pope/SOPA Images/LightRocket via Getty Images)

“Its more immediate value may lie in reducing friction in financial services and state entitlements rather than directly cutting fraud,” he said.

Responding to criticism on the petition, the government said: “We will introduce a digital ID within this Parliament to help tackle illegal migration, make accessing government services easier, and enable wider efficiencies.

“We will consult on details soon.”

In his speech, Starmer said of the digital ID: “It will make it tougher to work illegally in this country, making our borders more secure.

“And it will also offer ordinary citizens countless benefits, like being able to prove your identity to access key services swiftly – rather than hunting around for an old utility bill.”

Post Comment