“Are These Common Costs Eroding Your Retirement Dreams? Discover the 14 Everyday Expenses Retirees Can No Longer Bear!”

To save money, retirees are cutting back on their subscriptions, opting to keep only one or two streaming services, or even returning to free alternatives like YouTube or public TV. Some also switch to lower-tier plans that offer basic access, which helps keep costs under control without missing out on the entertainment they enjoy.

3. Health Insurance Premiums

As you age, health expenses become an unavoidable part of life, and health insurance premiums can take a big bite out of your retirement budget. Medicare might cover some of the basics, but most retirees still have to shell out for supplemental insurance to fill in the gaps. With the average Medicare Advantage Plan costing around $170 per month, plus potential out-of-pocket expenses, it’s easy to see how healthcare can strain a retiree’s finances.

Some retirees reduce their healthcare costs by staying as healthy as possible, exercise, eating right, and preventative care can go a long way. Others might shop around for the best insurance deals or take advantage of community health services to lower their premiums.

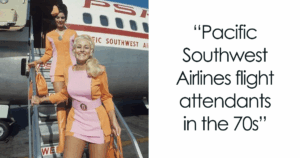

4. Travel

Ah, the dream of traveling the world once you retire. While many retirees manage to take a few vacations, travel is an expense that quickly adds up. From flights and accommodations to meals and activities, the average vacation can cost about $2,000 per person. That’s a big hit for anyone living on a fixed income.

To keep travel in the picture without breaking the bank, retirees are choosing more budget-friendly destinations or shorter trips. Road trips, camping, or staying with friends and family can also help reduce travel expenses while still satisfying the wanderlust that often comes with retirement.