Inheriting More Than Wealth: Woman Uncovers Hidden Secrets While Grappling with Unfinished Wishes of Her Late Father

We all know the saying: you can’t take it with you when you go — but boy, the decisions around who gets what afterward can feel like a minefield. Imagine splitting an inheritance and suddenly realizing your “fair share” looks more like a “crumb from the table,” even though you’re trying to honor your dad’s wishes. That’s exactly what happened to Mumsnet user MamaByTheOcean, who found herself juggling family duties, financial strain, and a growing sense of guilt all at once — talk about no time to grieve, let alone breathe. It raises the question: at what point do you stop sacrificing your own needs to satisfy everyone else’s expectations? And more importantly, how do you navigate the messy, emotional rollercoaster of inheritance without losing yourself in the process? Dive into this real-life tale that’s way more complicated than just dividing a pie. <a href="https://www.mumsnet.com/talk/amibeingunreasonable/5319611-to-not-give-anymore-of-my-inheritance-away-and-look-after-my-own-family” target=”blank” rel=”noopener noreferrer”>LEARN MORE

We can’t take our belongings to the afterlife, but we can decide who receives them after we pass away.

However, when Mumsnet user MamaByTheOcean began dividing her late father’s estate among all the intended beneficiaries, she ran into a problem. The woman started to feel that her own portion was shrinking too much.

She didn’t want to disrespect her dad’s last wishes, but the idea of not receiving what she believed was her fair share didn’t appeal to her either. So, she turned to the internet for advice on how to handle the situation.

After her father had passed away, this woman didn’t even have time to grieve

Image credits: demopicture / Envato (not the actual photo)

Since taking care of her late dad’s estate demanded so much effort

Image credits: YuriArcursPeopleimages / Envato (not the actual photo)

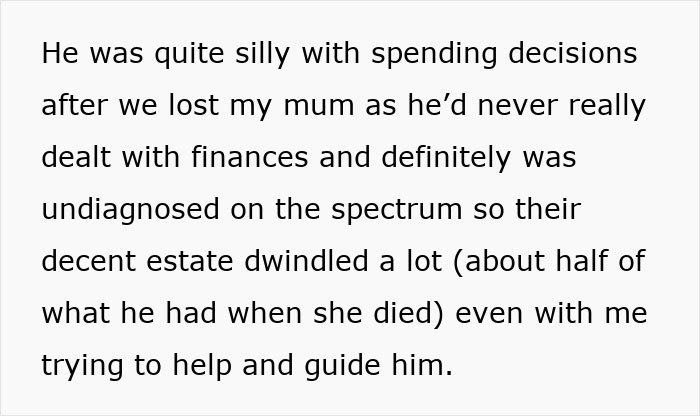

Image credits: MamaByTheOcean

We rarely talk about it, but inheritance comes with a myriad of challenges

First and foremost, after a family member’s passing, New York City-based grief therapist Natalie Greenberg advises people to grant themselves some grace before diving into financial matters.

“Each family has a unique relationship to money (how finances were dealt with, changes in financial situations, emotions tied to money, etc), so it’s understandable that a lot of emotions will arise while grieving, and even more while making big financial decisions,” she told Bored Panda.

Greenberg, who has over a decade of experience in helping people navigate loss, said, “To even ask this question demonstrates the person is being considerate and measured in a logistically complex and emotional situation.”

Britain, where the author of the post appears to be from, is entering the so-called golden age of inheritance, as the trillions accumulated by the postwar Baby Boomers begin trickling down to their children and grandchildren in what’s been dubbed the great wealth transfer.

At some point this year, £100bn ($133bn) – or more than half the annual budget of the National Health Service (NHS) – could be changing hands every year, according to an analysis commissioned by estate administrators the Kings Court Trust. By 2047, they estimate, that number could more than triple.

Around £5.5tn ($7.3tn) in total could flow down through families over the next 30 years, both in conventional legacies and increasingly in living gifts, which don’t attract inheritance tax if the donor survives for seven years after handing them over.

Image credits: Image by Freepik (not the actual photo)

The sums involved in the great wealth transfer are so high partly because the Boomers make up so much of the population – roughly a fifth.

As The Guardian’s columnist Gaby Hinsliff points out, it’s always been perfectly normal for older people to be richer than younger ones, having had a lifetime to accumulate property, pensions, and savings. But what has happened to those assets over a generation is unusual. House prices tripled in real terms between 1980 and 2020, and even a council house bought through Margaret Thatcher’s right to buy can be worth seven figures in some London areas.

One in four pensioner households is now worth over £1m on paper, even if they’re not cash-rich. Now, this windfall is heading down to the next generation – or to some of them – and the partitions are expected to cause tension. More money, more problems, as they say.

When the Joseph Rowntree Foundation conducted research into attitudes toward legacies back in 2005, it found two-thirds of those potentially wealthy enough to leave something weren’t worried about organizing their finances to do so and just wanted to enjoy the fruits of their labor.

Because of this, many of their children are now finding themselves in similar positions as the woman behind the post.