This £1,000 Apple Investment 10 Years Ago Could Make You Unrecognizably Rich Today – Discover How Much!

So, imagine this: you dropped a crisp grand on Apple a decade ago—just a cheeky little gamble—and boom! You’d be sitting on a goldmine right now. Funny thing is, while Apple was already flexing as one of the biggest tech behemoths back then, nobody—except maybe that sharp-as-a-tack Warren Buffet—saw that kind of jackpot coming from just £1,000. Back in 2015, Apple was riding high, having launched the iPhone 6 and their first-ever smartwatch, with stock prices playing a nifty 4-for-1 split game. Fast forward to today, and that investment would have ballooned to nearly eight times its original size. Makes you wonder—what could be next for this giant? Let’s dig into the numbers, the hype, and the head-scratchers surrounding Apple’s stock journey. LEARN MORE

If you were smart enough to put a few quid on Apple 10 years ago, then you would have got a wonderful return on your investment.

While the tech giant was still one of the biggest companies in the world at the time, no one apart from Warren Buffet would have expected such a return from just a £1,000 investment.

Back in 2015, Apple had released the iPhone 6 and had only just brought its first ever smart watch.

It’s stock price was around $125, prior to the stock split. In Apple’s case, their 4-for-1 stock split in 2015 meant that for every 1 share owned, you receive 4 shares, but each share is worth one-quarter of the original price.

So pre-split, the stock price at the time would have been around $31.25. And fast forward to today (19 July), and the price is about $211.18.

How much money would you have made from an Apple investment?

Apple’s share price has gone down this year (Jaap Arriens/NurPhoto via Getty Images)

Taking to account Apple’s current share price at the time of writing, you would have got an approximate 786 percent return over 10 years.

Including exchange rates, a £1,000 investment in 2015 would be worth roughly £7,864 today.

If you invested five years ago

ROI: 360 percent

Total as of 19 July: £4,585

If you invested one year ago

ROI: -7 percent

Total as of 19 July: £933

What could be next for Apple stock?

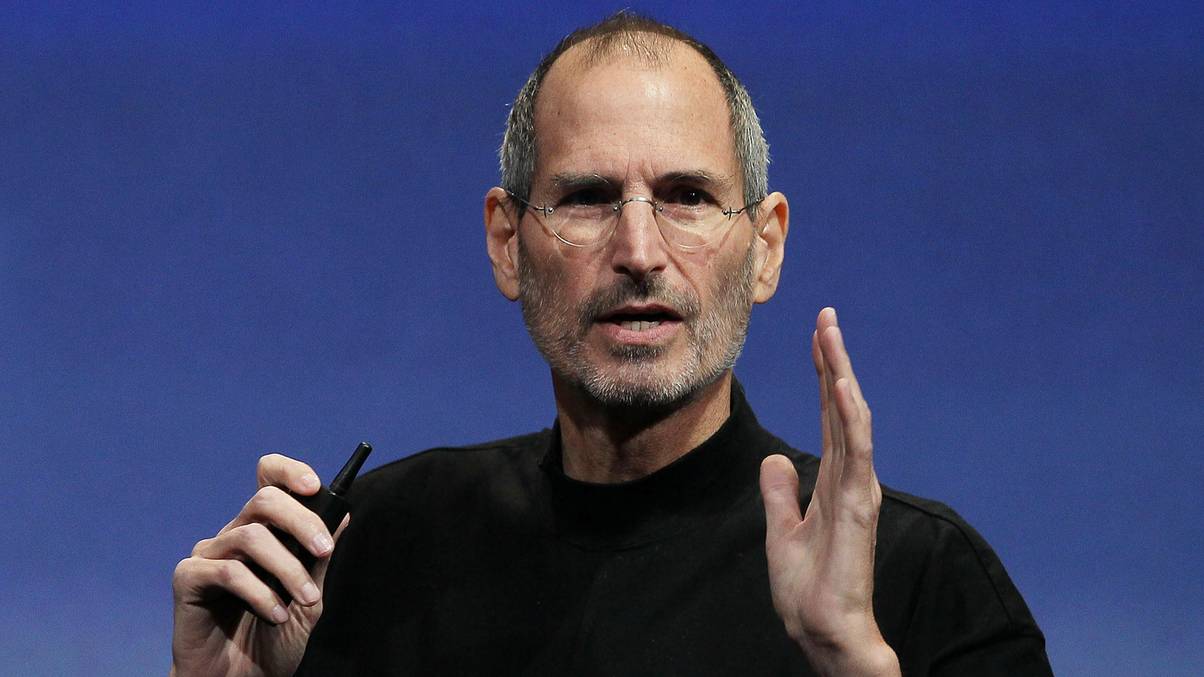

Apple launced Apple Pay in 2015 (Peter Macdiarmid/Getty Images)

Dan Ives, an analyst at Wedbush Securities, is optimistic about Apple’s stock, raising his price target for next year to $325.

In an interview with CNBC last year, he credits the potential of AI-driven upgrades, predicting that Apple is set to enter its ‘golden era’.

“Now that AI is gaining momentum, I think Apple will keep finding new ways to stay ahead,” added Taylor Kovar, CFP, founder of 11 Financial.

“They’ve already set the bar — first with fingerprint recognition, then Face ID.”

In June as part of their announcement for iOS 26, one of the potential updates features the ability to translate languages in real time through AI.

What the critics are saying

As reported by Yahoo Finance in January, Luna Kandy, a financial expert and the CEO of Luna Candy Co., has warned that the stock price will largely depend on the economy.

“Global economic conditions, like inflation rates and consumer spending trends, could impact demand for Apple’s premium products,” Kandy said.

“Additionally, regulatory scrutiny, particularly in Europe and the U.S., could affect their business operations, especially around the App Store and privacy issues.”

With all stocks and shares investments, the price really can go either way and investors are always cautioned to put money in at their own risk.

I mean, look what happened when Trump started playing around with the tariffs. Anything can happen.

Auto Amazon Links: No products found.