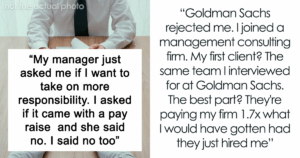

“Unmasking America’s Debt Dilemma: 14 Shocking Financial Habits You Didn’t Know Were Hurting Your Wallet”

1. Equating Splurges with Happiness

Many Americans develop the mindset that they deserve “nice things” and to be happy. While this may be true, it shouldn’t be to the detriment of their savings accounts. Most of us can have nice things without splurging unnecessarily on high-ticket items we know we can’t afford. Plus, no item or price tag will truly lead to happiness.

2. Wasting Money Regularly

Somehow, many people get stuck in wasteful spending habits. Whether it’s having too many subscriptions (for TV shows, meals, entertainment, etc.) or buying more than needed for weekly groceries (think impulse buys on snacks, junk food, fruit, etc.) can quickly balloon into spending well beyond our means.

3. Debt is Worth it for a Dream Home

Unfortunately, many people will always try to take out the maximum amount of mortgage that they are approved for, often stretching themselves thin in order to buy their “dream home.” This mindset is deeply rooted in the American dream of homeownership, but it also contributes heavily to debt because people tend to underestimate the full cost of owning a home (including taxes, insurance, and maintenance).

Additionally, many individuals don’t consider the potential risks of being tied down to a mortgage, such as an inability to move for better job opportunities or being forced to sell at a loss due to market fluctuations.

4. Must Have a New Car

The idea of constantly needing to have the newest and best possessions has been ingrained in our culture for decades. Nowhere is this more evident than in the car industry. Every year, new car models are released with updated features and designs, enticing consumers to upgrade their vehicles.